Charitable Gift Annuities

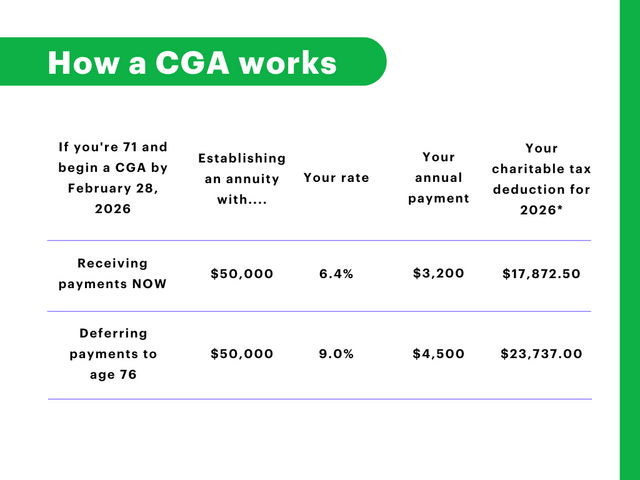

A gift annuity is a smart way to make a charitable gift to McDaniel College and receive guaranteed lifetime income, either now or in the future. Most people who create a gift annuity receive a Federal income tax deduction, as well as a portion of this income tax-free.

CGA rates are UP and more attractive than ever. You can receive a personalized example of how a tax-smart CGA gift can work for you.

A Gift for YOU - and the Hill!